About us

What Do You Mean by Income and Expenses?

Income refers to the money that your business earns from various sources such as sales, services, and other business activities. Expenses, on the other hand, are the costs incurred in the course of running your business, including salaries, rent, utilities, and materials. Managing income and expenses effectively is

crucial for maintaining the financial health of your business.

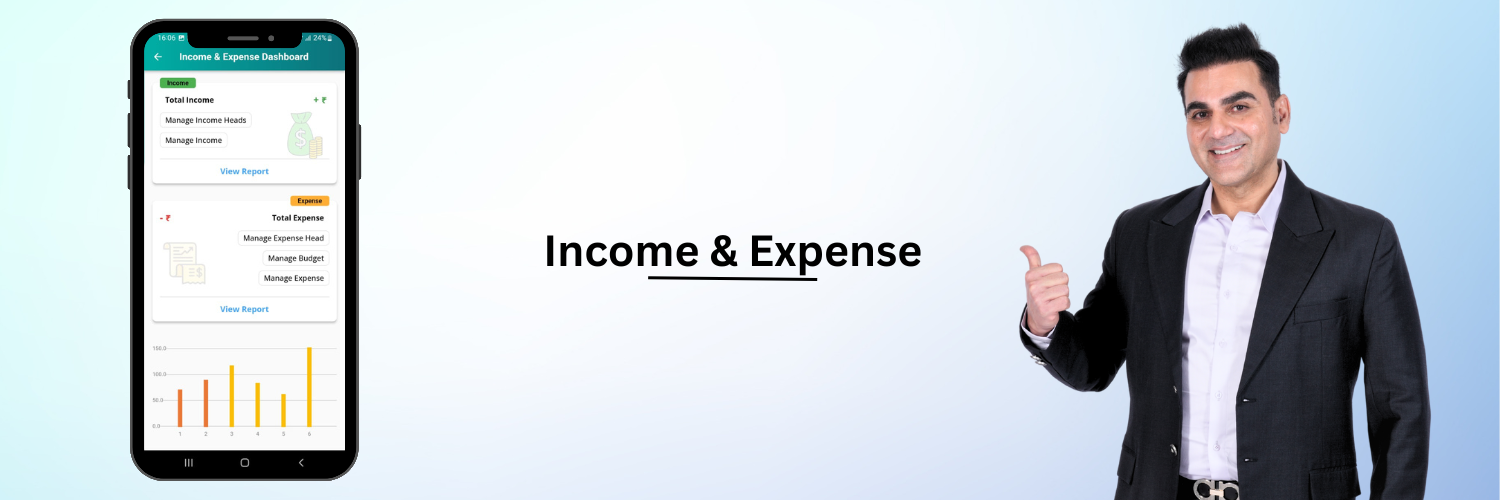

Real Guru's Income and Expenses business tool offers a comprehensive solution for tracking and managing your business finances. Here are the key benefits

Budget Monitor

The Budget Monitor feature helps you keep track of your financial plan, ensuring that your spending aligns with your budget. This tool allows you to set budgets for different categories and monitor your expenses in real-time, preventing overspending and ensuring financial discipline.

Budget Indicator

The Budget Indicator provides a visual representation of your budget status. It shows you how much of your budget has been used and how much remains, helping you make informed financial decisions and avoid budget overruns.

Multiple Categories / Create New Category

The tool allows you to categorize your income and expenses into multiple predefined categories, such as marketing, operations, and payroll. Additionally, you can create new categories specific to your business needs, ensuring a tailored and organized financial tracking system.

Graphical Report

Graphical reports provide a visual representation of your income and expenses, making it easier to understand your financial data at a glance. Charts and graphs help you identify trends, spot anomalies, and make data-driven decisions for your business.

Yearly and Monthly Report

Generate detailed yearly and monthly reports to get an in-depth view of your financial performance over different periods. These reports help you track your progress, compare financial data year-over-year or month-by-month, and plan for future growth.

Balance Sheet

The Balance Sheet feature provides a snapshot of your business’s financial position at any given time. It lists your assets, liabilities, and equity, helping you understand your net worth and financial stability.

How the Income and Expenses Tool Helps Your Business Grow

*Enhanced Financial Visibility

By providing clear and organized financial data, the tool enhances your understanding of your business’s financial health, enabling you to make informed decisions.

Better Budget Management

The Budget Monitor and Budget Indicator features ensure that you stay within your financial limits, preventing overspending and promoting efficient use of resources.

*Improved Financial Planning

Yearly and monthly reports, along with detailed balance sheets, help you plan for future growth by providing insights into your financial performance and trends.

Customizable Tracking

The ability to create new categories for income and expenses ensures that the tool meets your specific business needs, providing a tailored financial management solution.

Informed Decision Making

Graphical reports make it easier to visualize your financial data, helping you make data-driven decisions that can enhance your business’s profitability and growth.